As a financial advisor, one of the most common questions I receive is, “How will this market affect my investments?” Watching the markets fluctuate can be difficult. During times like these, I like to circle back with clients to remind them of some key advice.

Remember the evidence.

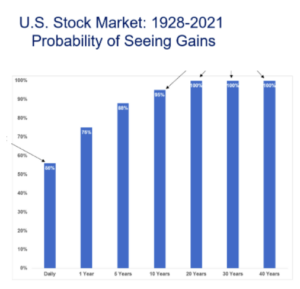

The long-term trajectory of the market is upward. There will be peaks and valleys as the market makes its way up that we must endure. We can tolerate the irrational behavior of the stock market because of the returns they yield in the long run. For money you may want in the near term, options like bonds and savings accounts are where you want to keep this money. These accounts don’t endure the ups and downs of the stock market and are a safer option for short-term investments.

Manage your exposure to breaking news.

Turn off the news, log off your social media, and get out into nature or watch something funny on TV. Modern-day media is designed to shock or scare you to get your attention. Everything is a crisis. We know stocks go down; it happens regularly. It’s not a glitch in the system, but a feature of the stock market. Find a way to limit your exposure to sensational news and trust the historical evidence of markets recovering.

Talk to us.

The thing about the stock market is it doesn’t provide an accurate timeline of when it will take a turn. We never know how severe it will be or how long it will last. But we do know markets inevitably tank now and then, and we also fully expect they’ll eventually recover and continue their upward trend.

Visuals can be very helpful during times like these. I love this chart because it explains why we invest in stocks for the long term. Given time, the U.S. stock market has consistently produced gains for investors that can stay the course.

If you have questions about your investments or are ready to build a successful investment portfolio, please feel free to reach out to us. To learn more about what you can do during down markets, read this article.