If there is a universal investment ideal, it is this: You want to buy low and sell high. What if we told you that there was a process for automatically doing just that? You’d rush to use it, wouldn’t you? Guess what – there is. It’s called rebalancing. Helping you rebalance your portfolio so you’re consistently buying low and selling high while staying on track toward your personal goals is another way that HHWM seeks to add good value as your investment advisor.

Portfolio Rebalancing: How It Works

When we create your portfolio, we do so according to particular percentages defined in your personalized Investment Policy Statement (IPS). As the markets shift around, your investments tend to stray from their original, intended “weights” or allocations. Rebalancing is the act of shifting those allocations back where they belong.

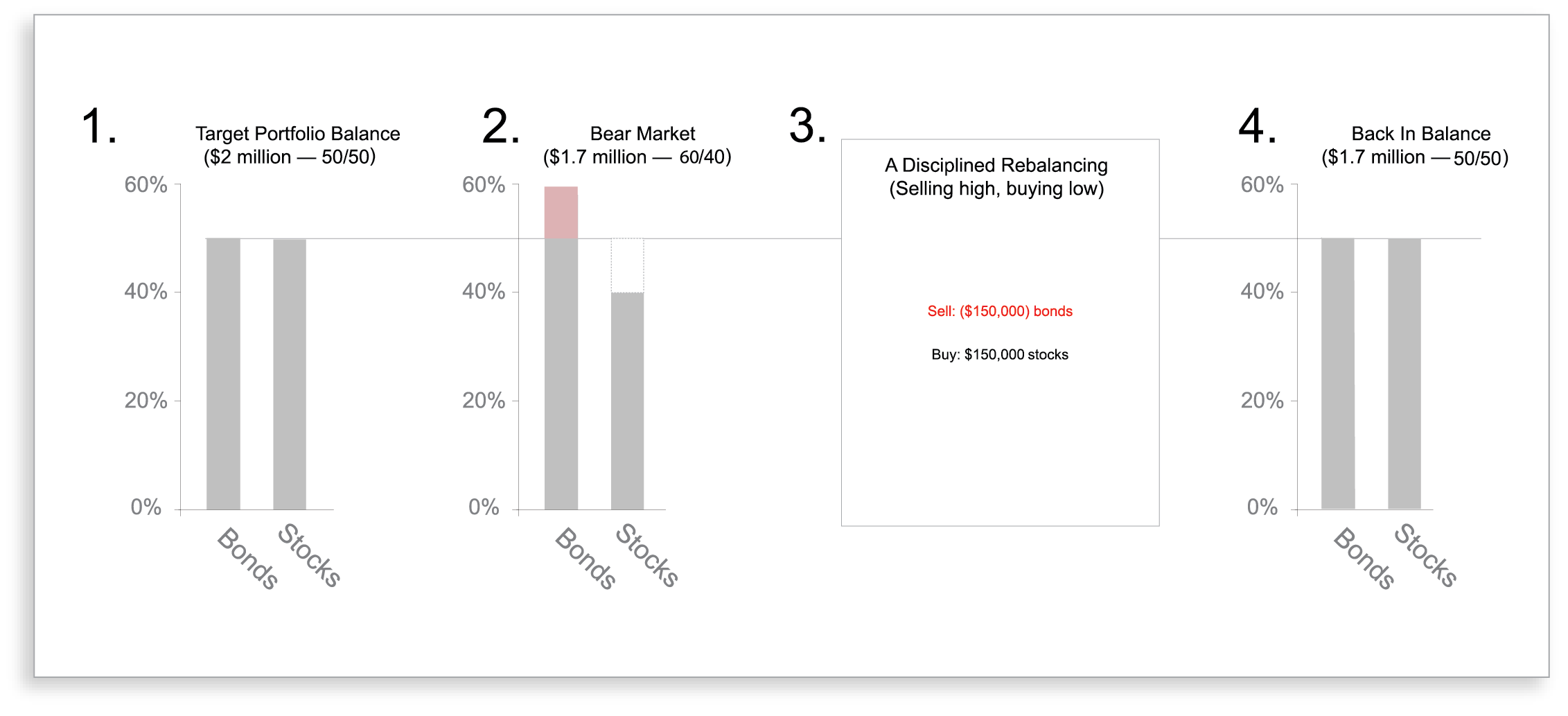

To illustrate, imagine your portfolio is supposed to be half stocks and half bonds. When the stock market outperforms the bond market, you end up with too many stocks relative to bonds. Or of course the reverse can happen. Either way, you’re no longer at your intended 50/50 mix. To rebalance your portfolio, we can sell some of the now-overweight assets, and use the proceeds to buy assets that have become underrepresented, until you’re back at or near your desired mix.

Did you catch what just happened? Not only are we keeping your portfolio on track toward your goals, but we’ve just bought low and sold high. Better yet, the trades were not a matter of fancy guesswork or emotional whims. The feat was accomplished according to your carefully crafted, customized plan.

Portfolio Balancing: A Closer Look

Rebalancing is a little more complicated, in that it’s a plural versus singular activity. First, we build a balance between stocks versus bonds, reflecting your need to take on market risk in exchange for expected returns. Then we typically divide these assets among stock and bond subsets, again according to your unique financial goals. For example, we are likely to assign percentages of your stocks to small- vs. large-company and value vs. growth firms, and further divide these among international, U.S., and/or emerging markets.

The reason for these relatively precise allocations is to expose you to the right amount of expected market premiums for your personal goals, while offsetting the market risks involved by spreading them around the globe.

We also use passively managed funds for implementation, so we can maintain improved control over your portfolio. An actively managed fund typically has much wider latitude to vary its underlying make-up as it tries to time the market. For example, in a bear market, a passively managed stock fund remains steadfastly invested in stocks. Its actively managed counterpart is more likely to sell off some of its stocks and move to cash. That means its unwitting fund holders are likewise selling stocks (low) and rebalancing into cash. They’re also likely paying more for the “privilege” of losing control over their asset allocation (with no expected benefit gained).

Striking a Rebalancing Balance

In short, rebalancing with passively managed funds is integral to helping you succeed as an investor. But like any power tool, it should be used with care and understanding.

It’s scary to do in real time. Everyone understands the logic of buying low and selling high. But when it’s time to rebalance, your emotions make it easier said than done. This is where we come in as your advisor, to help prevent your emotions from interfering with your reason. To illustrate, consider a couple of real-life scenarios.

- When times are bad: Bad times in the market can represent good times for rebalancing. But that means you must sell some of your assets that have been doing okay and buy the unpopular ones. The Great Recession of 2007–2009 is the quintessential example. To rebalance then, you had to sell some of your safe-harbor holdings and buy stocks, even as popular opinion was screaming that stocks were dead. Of course history has shown otherwise; those who did rebalance were well-positioned to capture available returns during the subsequent recovery. But at the time, it represented a huge leap of faith in the academic evidence indicating that our capital markets were expected to prevail.

- When times are good. An exuberant market can be another rebalancing opportunity – and another challenge, as you must sell some of your high-flyers (selling high) and rebalance into the lonesome losers (buying low). At the time, this feels counterintuitive. But those who rode the 1990s dot-com wave through its crest can understand why it’s a good idea to periodically shift some of your captured returns to safer grounds.

Costs must be considered. Besides combatting your emotions, there are practical concerns. If trading were free, we could rebalance your portfolio every day with absolute precision. In reality, trading incurs transaction fees as well as potential tax liabilities. To help us achieve a reasonable, middle ground, we have guidelines for when and how to cost-effectively rebalance. We also use any new money added to your portfolio to perform efficient rebalancing whenever possible. We’re happy to go over the rest of our guidelines with you anytime, if you’d like to know more.

The Rebalancing Take-Home

Rebalancing using passively managed funds makes a great deal of sense once you understand the basics: It gives you a clear, evidence-based process and effective, low-cost solutions for staying on course toward your personal goals through rocky markets. It ensures you are buying low and selling high along the way. What’s not to like about that?

At the same time, rebalancing within your globally diversified portfolio requires both emotional resolve as well as informed management, to ensure it’s being integrated consistently and cost effectively. Helping you periodically rebalance your portfolio is another vital way Hiley Hunt Wealth Management seeks to add value to your investment experience.